In Friday’s On My Radar, Steve offered his monthly look at market valuations. The data shows that they remain high by most every measure, however Steve says that it doesn’t mean stocks don’t move higher. Click below to see the most recent data.

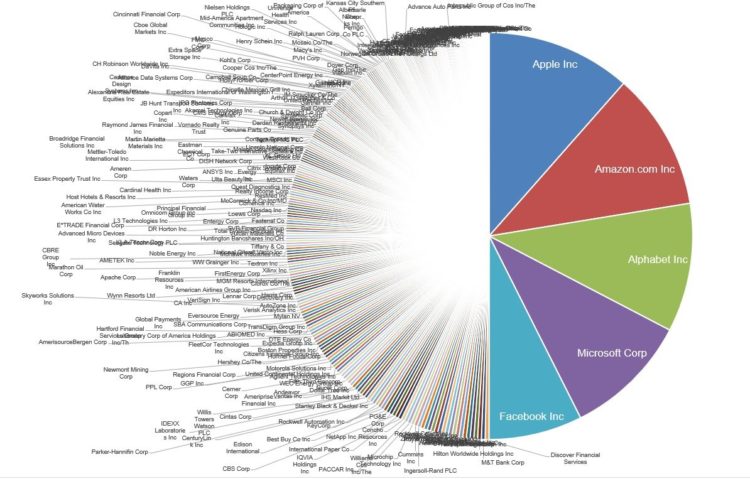

READ MOREFAANGs Dominate S&P 500

The market cap of the top five S&P 500 companies: $4.1 trillion… The market cap of the bottom 282 S&P 500 companies: $4.1 trillion. Just saying…

Source: Michael Batnick, CFA. http://theirrelevantinvestor.com/2018/07/19/pareto/

Risk-On or Risk-Off?

In Friday’s On My Radar, Steve Blumenthal discusses his favorite market risk-on/risk-off indicator: the Ned Davis Research CMG U.S. Large Cap Long/Flat Index. The Index measures “market breadth,” which, generally speaking, is a measure of market activity, such as how many stocks are advancing higher in price and how many are declining, how many are making new highs and new lows, is the trading volume advancing or decreasing in size and is price momentum strong or weak by looking at the number of stocks that are in uptrends and downtrends.

The NDR/CMG process measures market breadth by analyzing the overall technical strength across 22 individually measured sub-industry sectors. The process measures the trend of each of the sub-industry sectors, evaluating the rate of change in price momentum over short-term and long-term time frames and directional trend of each sub-industry sector.

Click below to find out what this important indicator is telling us about current market breadth and whether we should be risk-on or risk-off.

READ MORENASDAQ’s Jill Malandrino Interviews Steve Blumenthal

Last week, NASDAQ’s Global Market Reporter, Jill Malandrino, interviewed Steve Blumenthal at the Philadelphia Stock Exchange.

Steve discussed the Fed’s recent interest rate hike and its plans for additional increases this year. Steve urged caution, noting that 10 of the last 13 interest rate increase cycles have landed the US in recession. Click below for the full interview and potential moves investors can make to protect and preserve.

Recession Watch Indicators

Recently, we offered current U.S. recession watch charts, including the Employment Trends Index, the Economy and the S&P 500 Index, and Inverted Yield Curve.

It’s critically important to remain vigilant and to check these indicators regularly because the next great buying opportunity could be right around the corner.

The current recessions charts indicate…

READ MOREThe Debt Bubble and Interest Rate Trigger

Our equity market trend model signals remain moderately bullish and our bond market trend model signals remain bearish. With that caveat, we’re speeding down the road with limited visibility to the problem that exists just around the next turn. The mother of all bubbles exists and it is in the debt markets. It is global in scale and there is no easy way around the problem. Like bubbles past, this too will pop. The trigger? Rising interest rates.

The debt situation in the U.S. is bad. As of December 31, 2017, it stands at 329% debt-to-GDP. It’s worse in the Eurozone, which is currently at 446% debt-to-GDP. For perspective, credible studies show countries get into trouble when debt-to-GDP exceeds 90%.

But what does this really mean for the economy and for you?

READ MOREEquity Market Valuations and Probable Forward Returns

At which point do rising interest rates spark the fire? Rates are key to the equation of risk. In Friday’s On My Radar, Steve surveys what the current equity market valuations tell us about risk… and likely forward returns. Should you be playing more offense than defense or more defense than offense? Valuations can help.

READ MOREBlumenthal’s 2018 Market Outlook

In Friday’s On My Radar, Steve provides his much-anticipated market outlook for 2018.

Steve says, “The weight of market trend evidence remains bullish. I remain focused on both market momentum and trend evidence. Despite the aged, overvalued and over-bullish environment, as evidenced in Trade Signals each week, I remain moderately bullish on both equities and fixed income.”

READ MOREBlumenthal Interviewed by Nasdaq

On Friday, December 15, CMG Founder and CIO Steve Blumenthal was interviewed by Nasdaq global markets reporter Jill Maladrino. Jill asked Steve about the current state of the market, his 2018 outlook and his recent On My Radar piece called “Start Small, Grow Tall.”

Click below to watch the short interview.

Bob Rubin Interviews David Swensen

In Friday’s On My Radar, Steve links to a great interview of David Swensen, Yale’s CIO, by former Goldman co-chairman and former Treasury Secretary, Robert Rubin.

Take a few minutes and watch the interview. It’s worth it. Add Swensen to the list of famed investors predicting low single-digit forward returns. He shares some sage advice on portfolio management and diversification.