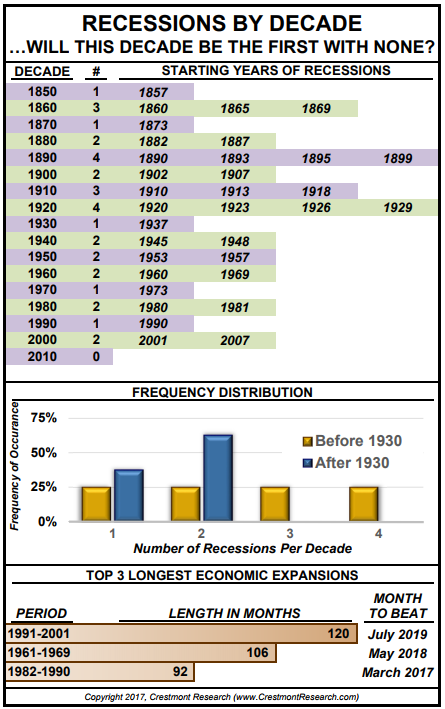

Recently, we offered current U.S. recession watch charts, including the Employment Trends Index, the Economy and the S&P 500 Index, and Inverted Yield Curve.

It’s critically important to remain vigilant and to check these indicators regularly because the next great buying opportunity could be right around the corner.

The current recessions charts indicate…

READ MORE