CMG Capital Management Group CEO Steve Blumenthal takes a sobering look at debt across the globe in his latest Forbes article Creative Destruction And Managing The Risk of Global Debt. Excerpt:

CMG Capital Management Group CEO Steve Blumenthal takes a sobering look at debt across the globe in his latest Forbes article Creative Destruction And Managing The Risk of Global Debt. Excerpt:

Search Results for: forbes

Blumenthal’s 2015 Investment Preview In Forbes

By Steve Blumenthal, CEO and portfolio manager, CMG Capital Management Group

I wrote often throughout 2014 about the danger signals flashing from an excessive run up in debt and derivatives. We have a repeat of the scenario we suffered in 2008, only much worse (Watch Junks Bonds For Early Warnings Of New Financial Crisis). The budget recently passed by Congress put taxpayers on the hook for a 2008-like derivatives failure. The potential losses could exceed the previous financial meltdown as other world market conditions exacerbate a bad situation.

I wrote often throughout 2014 about the danger signals flashing from an excessive run up in debt and derivatives. We have a repeat of the scenario we suffered in 2008, only much worse (Watch Junks Bonds For Early Warnings Of New Financial Crisis). The budget recently passed by Congress put taxpayers on the hook for a 2008-like derivatives failure. The potential losses could exceed the previous financial meltdown as other world market conditions exacerbate a bad situation.

As a risk manager, I need to acknowledge and plan to mitigate these big, macro risks. At the same time, as a tactical manager, I acknowledge that right now the weight of evidence points to a continued positive trend for this mega bull market.

In a world of excessive debt and unprecedented Central Bank intervention, where is a global investor to go? For now, the best place remains in U.S. equities.

Global debt continues to be the #1 concern going into 2015. A sovereign debt crisis looms on the horizon yet for now the creativity of global central bankers has kicked that can down the road. It is desperation time in Japan and the Eurozone is not far behind. A number of factors favor the U.S. dollar and U.S. equities through mid-2015.

Read the rest of Steve Blumenthal’s 2015 investment preview in Forbes Looking Ahead To The Year That Interest Rates Will Finally Rise

Bonds A Buy Says Blumenthal In Forbes

How Can America’s Top Economists Be So Wrong?

How Can America’s Top Economists Be So Wrong?

That’s the question Steve Blumenthal, CEO Of CMG Capital Management Group, ponders in his latest Forbes article Why Bonds Are A Buy And Everybody Had It Wrong.

Not a single Wall Street analyst polled in December 2013, predicted rates lower than 2.90% by the end of 2014. Goldman Sachs’ estimate was for a 3.25% yield by year-end. Then, the yield was 2.99%. It’s at 2.40% today.

If America’s top economists have been so wrong (so far) about interest rates, what chance does the average investor have? Where can we look, if not to economists, for signals that will guide investment decisions in this dicey interest rate environment?

Blumenthal On Zweig Bond Model In Forbes

CMG Capital Management Group CEO Steve Blumenthal initiated his monthly analysis of the Zweig Bond Model in Forbes. See Zweig Bond Model Remains Bullish.

Created in the mid 1980’s by famed investor Marty Zweig, the Zweig Bond Model’s objective is to invest in bonds with longer maturities when interest rates are declining (a good environment for bond investments) and to invest in shorter-term instruments when interest rates are rising (a bad environment for bond investments).

It’s a mathematical and unemotional process. While Wall Street was saying interest rates will head higher in 2014, this process stayed invested in longer-term bond funds and bond ETFs. So far, year-to-date, that has been the right move (bullish buy signal for bonds).

Blumenthal on High Yield Bonds in Forbes

CMG Capital Management Group CEO Steve Blumenthal sounds the alarm on high yield bonds in his latest Forbes article (excerpt below). See the whole article here: Code Red In High Yield.

CMG Capital Management Group CEO Steve Blumenthal sounds the alarm on high yield bonds in his latest Forbes article (excerpt below). See the whole article here: Code Red In High Yield.

Steve is off this week, enjoying a vacation in Nantucket. Read about that and his further discussion of the dangers/opportunity in the high yield market in his 7/25/2014 On My Radar: “Seen through my lens, another “once in a generation” buying opportunity is fast approaching. I remember saying the same thing in 1999 and 2007. The lines between generations must be shrinking as such opportunities seem to appear about once every seven years or so.”

In my 20 years of managing high yield bond investments, I’ve never seen so many signals that scream caution. Desperate to find yield, investors have poured billions into high yield bond funds and ETFs driving the yield on the Barclays High Yield Bond Index to just 5.54% — the lowest level in history. Investors are positioning in a risk they may not fully understand.

Let’s look at what will lead to the next default wave and discuss a tactical strategy that may help you further participate in price gains and also protect your wealth during periods of significant price loss.

– Forbes Code Red in High Yield.

High Corporate Debt Threatens Profits

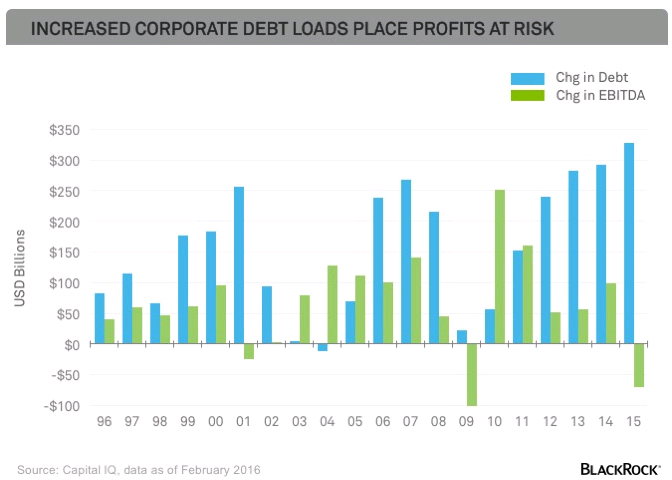

As you see in the next chart, increased corporate debt loads place profits at risk.

It’s profits we need to worry about especially when valuations are high. This is a headwind to further market upside.

If you want to get a good sense for why high valuations lead to poor future returns, I wrote a piece this week for Forbes titled, Plump P/E Ratio Suggests Subdued Stock Market Returns Ahead.

The point is that debt is a drag on profits. It is concerning now but will be even more concerning when interest rates begin to rise. So it is forward we must set our gaze.

Trend Neg For Stocks And HY; Relative Strength Leadership For Utilities And Fixed Income

The trend remains negative for equities and high yield. We continue to see relative strength leadership in utilities, fixed income, tax-free fixed income and gold. Investor sentiment remains extremely pessimistic. This supports a short-term oversold bounce in equities.

The trend remains negative for equities and high yield. We continue to see relative strength leadership in utilities, fixed income, tax-free fixed income and gold. Investor sentiment remains extremely pessimistic. This supports a short-term oversold bounce in equities.

The Global Recession Watch indicator continues to show a probable global recession has started. See my U.S. Recession Signals Intensify article in Forbes here.

Top Investing Stories in 2015

CMG is committed to investor education and setting a high standard for ETF Strategists. We created AdvisorCentral to keep advisors informed about investments, the markets and the economy. Every week we post analysis and market insight into tactical investing from CEO Steve Blumenthal, backed by the CMG research and portfolio management team. Following is a sampling of some of the stories from 2015. Want to get an email every Monday morning with the top stories from AdvisorCentral? Sign up here.

CMG is committed to investor education and setting a high standard for ETF Strategists. We created AdvisorCentral to keep advisors informed about investments, the markets and the economy. Every week we post analysis and market insight into tactical investing from CEO Steve Blumenthal, backed by the CMG research and portfolio management team. Following is a sampling of some of the stories from 2015. Want to get an email every Monday morning with the top stories from AdvisorCentral? Sign up here.

Blumenthal in Bloomberg on Junk Bonds

CMG Capital Management Groupo CEO Steve Blumenthal is quoted in the Bloomberg story Creditors Bawl: How Investors Ignored Risk of Junk-Bond Rout.

How To Profit From Runaway Debt And The Next Global Recession

Steve Blumenthal’s latest Forbes article outlines three big investing and market risks in 2016, and how investors might capitalize on opportunities presented in these scenarios. The beginning of the story is below, with a link to the full copy. See the archive of Steve Blumenthal’s catalog of Forbes articles.