Today, let’s take a look at the most recent market valuations and what they are telling us about forward returns over the next ten years. But keep in the back of your mind that you can get pretty close on seven and ten-year return probabilities but it is a coin flip on what the equity returns will be over next number of months.

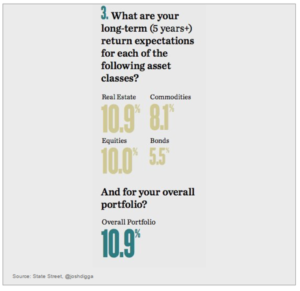

We do know that the insatiable demand for stocks with above average yield is causing valuations to diverge materially from historical norms. This may continue. In a recent State Street poll, investors were asked what their returns expectations are for the next five years and beyond for real estate, commodities, equities and bonds.

Answer: 10.9% for real estate, 8.1% for commodities, 10% for equities and 5.5% for bonds.

Answer: 10.9% for real estate, 8.1% for commodities, 10% for equities and 5.5% for bonds.

10% for equities? I find myself wondering who spiked their punch bowl.

I previously wrote that in December 1999, GMO’s seven-year forward return forecast predicted a negative annualized real (after inflation) return for stocks. They took a lot of heat but they were proven right.

In the intro quote above, Ben noted, “There is no panacea for the low returns implied by asset valuations today. Anyone suggesting differently is either fooling themselves or trying to fool you.” Amen brother.

Let’s go back a few years to another point in time when valuations were stretched and investors were “fooling themselves.” Note the two red arrows in the next chart…

For charts, analysis, and commentary see the rest of the story in On My Radar: Taking The “E” Train South | By Steve Blumenthal |

The current opinions and forecasts expressed herein are solely those of Steve Blumenthal and are subject to change. They do not represent the opinions of CMG. CMGs trading strategies are quantitative and may hold a position that at any given time does not reflect Steve’s forecasts. Steve’s opinions and forecasts may not actually come to pass. Information on this site should not be used as a recommendation to buy or sell any investment product or strategy.